How Tax Appraisers are Robbing Homeowners Nationwide Via A Property Tax Fraud Scheme that is Sure to Make the 2008 Financial Crisis Look Like Child's Play, and What You Can Do To Fight Back, Part 2

In the first article regarding the ongoing property tax scheme, we looked at the clear patterns of monetary theft the US government-banker, public-private partnerships have facilitated and engineered since the 1980s. This article will continue more of that pertinent history and will share additional details regarding the current homeowner taxation conspiracy, and what you can do if you are one of the millions of homeowners being robbed. Please make time to read Part 1 before delving into Part 2.

How Tax Appraisers are Robbing Homeowners Nationwide Via A Property Tax Fraud Scheme that is Sure to Make the 2008 Financial Crisis Look Like Child's Play, and What You Can Do To Fight Back

Are you a homeowner in the United States of America? Have your property taxes been skyrocketing over the past 7-8 years? You are not alone. This is happening to homeowners nationwide; but, contrary to what your county tax assessors might tell you, it has little to do with a booming housing market or an increased demand for housing. The US government…

Enter BlackRock

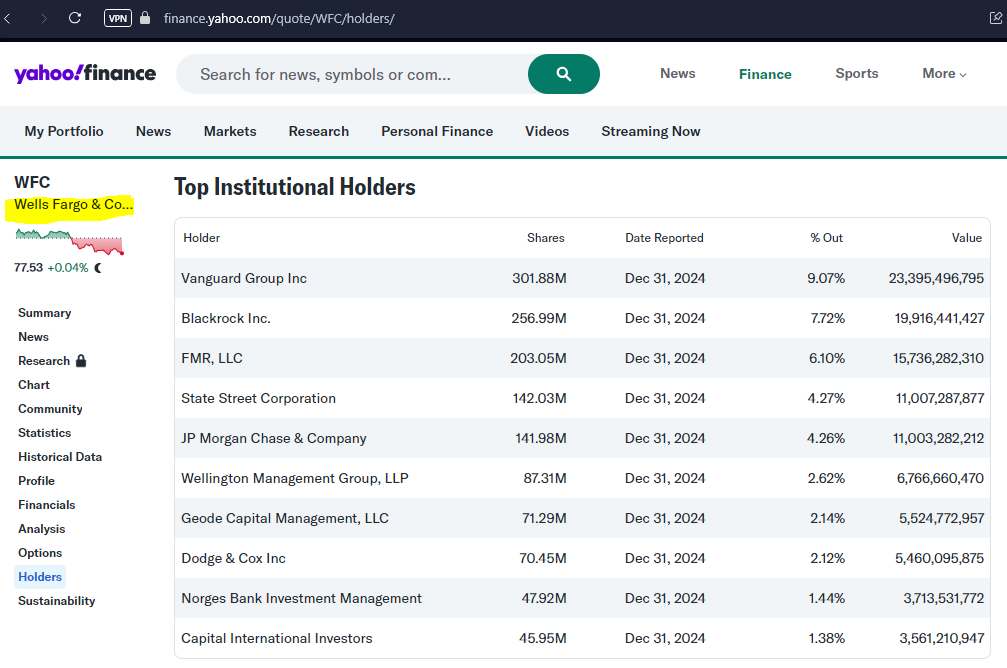

Founded in 1988, BlackRock is the world’s largest asset manager. They are a multinational firm who currently boast more than 11.5 trillion dollars in assets as of the final quarter in 2024. BlackRock is the primary investment firm of the World Economic Forum (WEF) oligarchs, followed closely by Vanguard Group, and State Street Global Advisors, respectively. The WEF partners with (collectively owns) many more investment firms, but BlackRock, Vanguard Group, and State Street are known as “the Big Three” in the financial world.

Vanguard Group is the largest shareholder of both BlackRock and State Street. State Street’s second largest shareholder is BlackRock. Vanguard Group has a unique structure that allows absolute secrecy regarding specifics on who its shareholders are. Unlike the others, Vanguard Group is also an exclusive firm who does not allow outside investors.

It’s a big club, and you ain’t in it!

If you look at the primary shareholders of ALL of the WEF’s investment firms, partnering companies, and banks, you will note that they all own one another. Some of the WEF’s other well-known financial institutions include: Berkshire Hathaway, Fidelity, Morgan Stanley, JPMorgan Chase, Goldman Sachs, Allianz, Citi (Citibank/CitiGroup), Wells Fargo, Capital One, The Bank of New York Mellon, Bank of America, Barclays, American Express, Visa, Mastercard, and PayPal. In short, their many firms are basically one monopolistic megacorporation.

Wells Fargo Shareholders

Morgan Stanley Shareholders

Citi Shareholders

Bank of America Shareholders

You can plug in the name of any of the top institutional holders in the lists above on Yahoo Finance, and get the exact same lists of WEF firms again and again— demonstrating, they all own one another. Vanguard Group is the only exception because, as previously mentioned, its shareholders are hidden from public view. Spoiler alert: Vanguard Group is owned by the Black Nobility bloodlines who have been ruling our world for millennia, which is why this company is structured so its shareholders’ names remain hidden. They are the real power behind the WEF-UN one world government.

A Quick Note Regarding the Central Banks and the Global Oligarchy

The Federal Reserve is a Central Bank. The Central Banks are owned by its member bank stockholders, ie. Blackrock, Vanguard Group, State Street and the other WEF financial behemoths. These banks include all national banks and many state banks.

The United States (US) is an Oligarchy according to a 2014 study published in Perspectives on Politics; it is not a Democracy nor a Democratic Republic. The study identifies that it is the so-called “elites” who control policy rather than US citizens. I will go one step further. It is the Global Banking Cartel (GBC) elites who are ultimately in control of the US and our world. The US president is an owned-agent of that Oligarchy. The US Senate and House Representatives are also bribed agents of this same Cartel. They fund our (s)elected candidates’ campaigns as an investment, assured that those they finance will obediently do their bidding for as long as they hold their office.

Back to BlackRock…

In 2008, the Federal Reserve and BlackRock entered into a cozy partnership, and in the wake of the 2008 Global Financial Crisis (GFC)— engineered by the US government and the banks— BlackRock officially became an advisor to the US Department of the Treasury. Since then, BlackRock has been at the helm of US fiscal policy in the Obama, Trump, and Biden administrations. Be assured, they will continue running US fiscal policy during the second Trump term.

During Trump’s first term, he chose Steve Mnuchin to lead the US Treasury. Mnuchin is a former Goldman Sachs executive who was mentored by George Soros. Soros, of course, is supposedly the Republican party’s arch nemesis in the divisive left-right theater that is US politics. Although Mnuchin was technically in charge of the US treasury, it was BlackRock’s Larry Fink who ran US fiscal policy, shuffling trillions of newly printed US dollars directly into BlackRock and other WEF-partner banking giants, after being tapped by the Federal Reserve. In fact, the COVID-19 emergency financial plan— The Going Direct Plan, written by BlackRock executives, had already been set in motion by the Trump administration and the Federal Reserve months before the plandemic declaration in March, 2020.

It’s easy if not trivial to look at a timeline of monetary events and see that the official monetary response to the “coronavirus pandemic” went into effect before there even was a pandemic. This means that the monetary “response” wasn’t initiated by any virus, but by something else. As it turns out, that something else was a radical monetary plan handed to the Fed for implementation six months earlier by BlackRock. Yes, that BlackRock—the one that had a central role in the Fed’s monetary “response,” which in actuality was nothing more than the execution of BlackRock’s plan.2

To put it bluntly, the actions taken by the Federal Reserve starting in March of 2020—actions that represented a massive departure from the Fed’s responses to crises before that time3—are exactly what BlackRock told the Fed to do in Jackson Hole, Wyoming over half a year before the World Health Organization (WHO) declared a pandemic. It was in August 2019, months before the first coronavirus story broke, that BlackRock instructed the Fed to get money into public and private hands when “the next downturn” arrived—which as luck would have it occurred less than a month later.

In a nutshell, this was BlackRock’s “going direct” plan,4 and what we are going to see here is how the Fed began executing—quite successfully—that plan (which enriched billionaires) before the pandemic was declared. The WHO’s declaration of the pandemic in fact coincides to the day with the Fed’s shifting BlackRock’s plan—already up and running—from mid-gear into high-gear, as the WHO had just armed the Fed with a huge cover story, the perfect distraction. Indeed, the Fed’s execution of BlackRock’s plan had shifted from low- to mid-gear a couple of weeks earlier, when the stock market plummeted following four months of trouble in the U.S. bond market.

The virus pandemic cover story thus permitted the Fed to kick the BlackRock plan into high gear with a massive and wholly unprecedented asset purchasing spree. But for the Fed, hyper aware of publicity as it is, the pandemic cover story came with a downside, which was that it had to actually do something to prop up the appearance of helping the public (which was and still is suffering badly under lockdowns).

In an effort to minimize that downside, the Fed came out with a rash of emergency measures that amounted to a handful of peanuts next to the trillions it was gifting billionaires. Those emergency measures arrived very late and were infected with admitted conflicts of interest at that. But those peanuts did buy the Fed some good press and enabled it to ride on the coattails of the Small Business Administration, which is where Main Street got real assistance—not from the Fed’s hackneyed jawboning.

To be clear, the Fed absolutely needed the 24/7 hype over the alleged pandemic as superficial justification for its massive $3 trillion balance sheet expansion, which in turn created $3 trillion of new money in private hands—exactly as BlackRock’s plan called for.5 Without the saturation air cover that the Fed had, its acts would’ve amounted to a naked money grab, which as it was even Jim “Mad Money” Cramer called one of the greatest wealth transfers in history.6

Taxation Without Representation

Although I am pretty sure at this point that everything we are told regarding history is either partially or fully untrue, supposedly, the American Revolutionary War was fought over the taxation of the US colonies by Britain without the government representation those taxes should have ensured. Well folks, clearly, the taxation without representation simply shifted from the British Monarchy to the US Oligarchy. In essence, nothing has changed.

Inflation is a tax. It is a tax that severely and disproportionately affects the poorest among us the most. The more dollars the Federal Reserve prints, the less those dollars are worth. This is why the cost of goods, rent, and utilities have been steadily increasing since Blackrock took the reigns after the GBC engineered the 2008 Global Financial Crisis. For the GBC, there was never any crisis— only opportunity; excessive taxation is however, a growing crisis for the rest of us.

The GBC literally prints currency out of thin air. This is the Cult’s money magick in action. Abra cadabra! They don’t need to tax (steal) the small amount of money the rest of us hold and must create with our labor and creativity. There is never any real shortage in funding because the GBC controls money printing. They control interest rates. They control all the ebbs and flows of all aspects of the global economy. So, if taxation is not necessary to fund governments, why do they tax, tax, tax us in every way possible? In short, it’s a way to create various monetary crises that will only negatively impact the rest of us, and is a method of oppression for those who exist outside their private Club. These engineered crises allow the oligarch-owned governments to absorb our wealth via various forms of taxation, which then gets laundered back to the oligarchs, usually through government bailouts of the monetary system. This cyclical pattern of outright theft, suppresses the greatest determinant of freedom from the other 99.9% of the population— specifically, financial wellness.

Circling Back to the Homeowner Tax Fraud Scheme

Although the Going Direct Reset executed the greatest wealth transfer in US history, the ongoing homeowner tax fraud scheme will dwarf that wealth transfer exponentially, according to Mitchell Vexler of Mockingbird Properties. Not only is USPAP and local tax appraisers siphoning the wealth of US homeowners illegally, but per Vexler, this is happening globally. Once these homeowners’ incomes are sufficiently drained through excessive taxation, and their tax burdens become impossible to afford, they could eventually be forced to sell their properties in an effort to keep their heads above water. This is the outcome desired by the WEF-UN conglomeration and their puppet governments. “You will own nothing, and you’ll be happy.” Then, their investment firms and real estate companies can purchase these properties so they can continue to grow their ginormous piece of the wealth pie as they take more and more from the sliver the public still temporarily holds.

The homeowner taxation scandal specifics are somewhat complicated, so instead of trying to explain it in depth with my novice understanding, please listen to Mitchell Vexler as he explains it. Vexler knows the industry, can cite the specific laws being broken, and thoroughly conveys all aspects of this taxation fraud scheme in a way that most will be able to follow.

Fight Back!

If you believe your property has been targeted and overtaxed by your local tax appraisers, Vexler suggests that you go speak with your neighbors before retaining an attorney. Attorneys are expensive and the amount of time the lawyer will have to invest just to begin to put together your case, will be considerable. Vexler says that you can reduce those out-of-pocket costs by gathering a group of similarly affected homeowners, and bringing the case as a class action suit instead. This way, you and your neighbors can split the attorney fees to reduce the cost burden on any one individual.

You can find additional information and resources for you and your attorney at Vexler’s website: https://www.mockingbirdproperties.com/dcad on his DCAD page. He has made this available for free in hopes of helping homeowners and their attorneys to have the details necessary to bring these cases to court, and to be successful in recovering some or all of the stolen wealth.

"If the American people ever allow private banks to control the issuane of their currency, first by inflation, then by deflation, they will one day wake up homeless and destitute on the continent their forefathers conquered"

- Thomas Jeffeson -

Glad someone touched on this. I've watch everybody purposely have more taxes paid just to enrich those in government.